Business Insurance in and around Binghamton

Get your Binghamton business covered, right here!

Insure your business, intentionally

- Binghamton

- Whitney Point

- Windsor

- Broome County

Your Search For Great Small Business Insurance Ends Now.

Operating your small business takes hard work, dedication, and great insurance. That's why State Farm offers coverage options like a surety or fidelity bond, errors and omissions liability, worker's compensation for your employees, and more!

Get your Binghamton business covered, right here!

Insure your business, intentionally

Protect Your Business With State Farm

Whether you own a pottery shop, a dry cleaner or a barber shop, State Farm is here to help. Aside from excellent service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

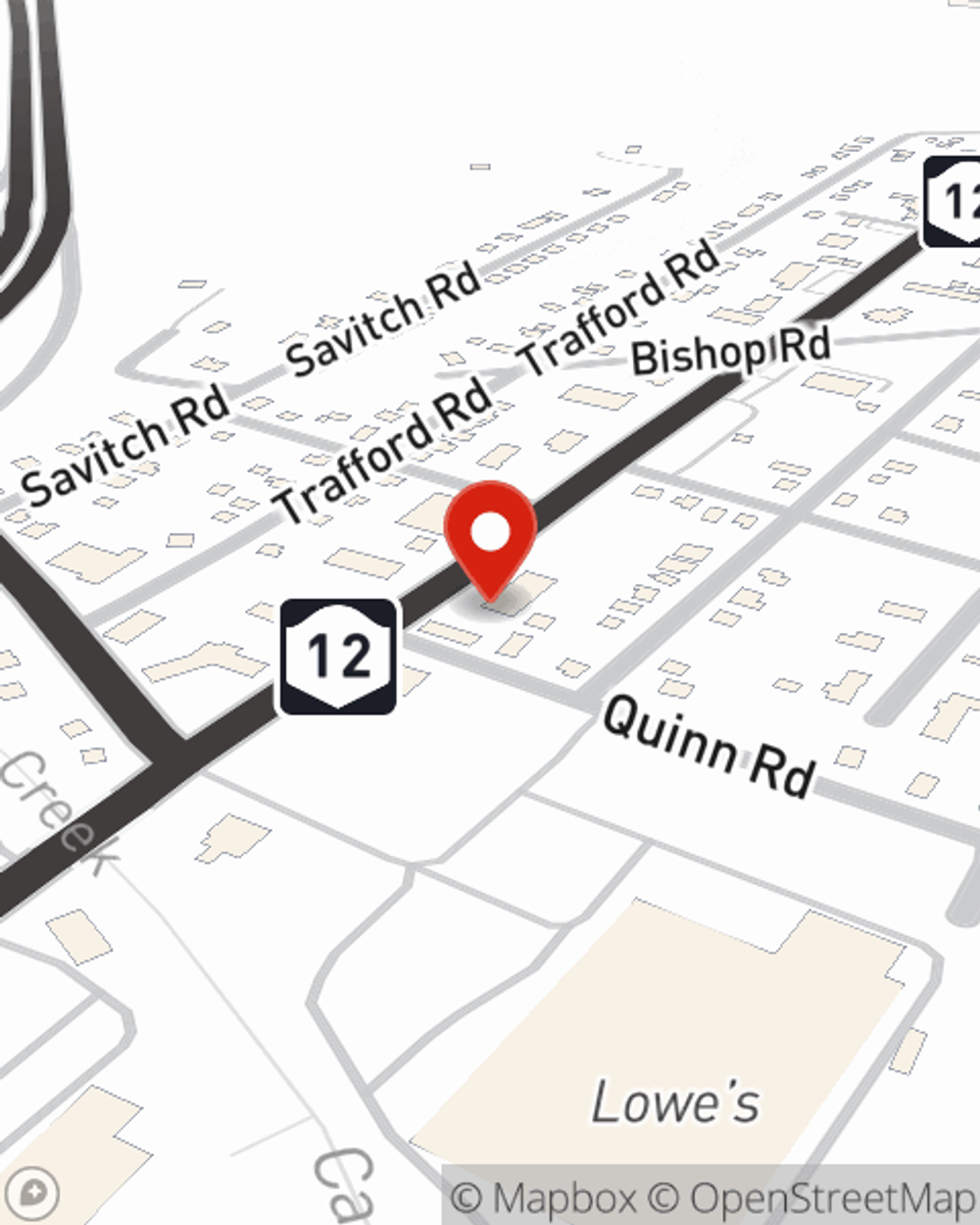

Ready to review the business insurance options that may be right for you? Visit agent Jim Rollo's office to get started!

Simple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Jim Rollo

State Farm® Insurance AgentSimple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.